When will Dubai real estate market recover?

Forecasting real estate cycles in transparent mature markets is not a straight forward process.

A common question asked by investors, financiers, developers, analysts and the curious, is when will the Dubai real estate market recover?

Usually the answer sought is related to the time period necessary for a recovery, rather than exploring the different factors that drive the market in the first place.

It has to be said that forecasting real estate cycles in transparent mature markets is not a straight forward process. It involves not only knowledge of the economic fundamentals that drive the real estate market, but also requires the long-term experience of going through multiple cycles and the wisdom of being able to look at the bigger picture and connecting all elements that make up the real estate market.

However, Dubai’s young, maturing and increasingly transparent market is unique in terms of its demand and supply dynamics, which makes answering the question a more challenging one.

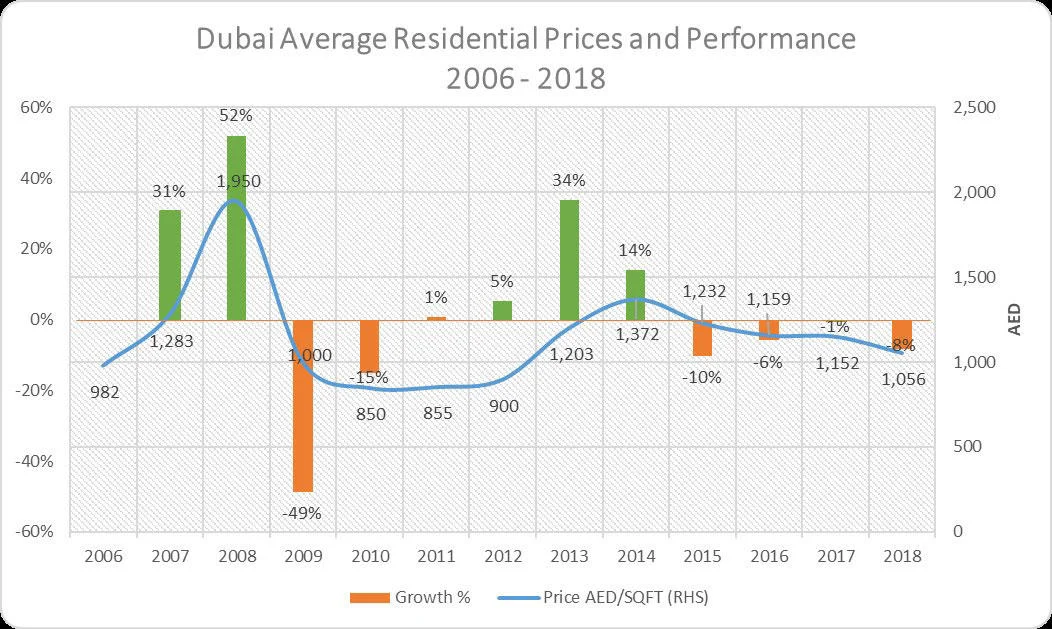

Arguably, Dubai has seen two cycles during the last ten years, as some say that the first cycle 2006-2011 was prematurely interrupted by the global economic downturn during 2008.

Regardless of whether the economic factors affecting the cycle were internal or external, the residential market in Dubai was extremely volatile due to highly speculative investors as prices shot up 83% in 2007 and 2008, only to be met with steep falls of 64% during the following two years.

At that point, no one was expecting the market to stabilise, and yet it did for two and half years as the market began to recover in 2012 marking the start of the second cycle.

As the market began to recover initially 5% during 2012, the following year saw the market going into an upswing, prompting the government to take measures, doubling registration fees and capping mortgage LTVs (loan-to-value) to cool a potential overheating, as prices grew by an unsustainable 34% in just one year.

The second cycle was interesting, as it came at a time when memories of the last cycle were fresh in many minds, and government-backed cooling measures were in place causing price growth to slow and finally peak during mid-2014, as the average price growth rate that year was 14%.

The unsustainable price growth of the previous two years coupled with falling oil prices and a weaker US dollar, pressured Dubai’s real estate cycle to go into a correction phase, as transacted prices fell 10% in 2015, 6% in 2016, then stabilised in 2017, and that’s when many analysts predicted market recovery the following year.

So did the market see any signs of recovery during 2018? Not at all. And the reason was not a straightforward one.

On one hand Dubai developers delivered many previously overdue projects causing a glut supply to come to the market within a short period of time. On the other hand, off-plan sales surpassed those of existing properties within established locations of Dubai, causing capital values of ready properties to decline as investors favoured competitively priced payment plans over the capped mortgage LTV and higher down payments.

Data representing the first half of 2019 suggested that Dubai has become a more affordable buyers’ market as the ValuStrat Price Index saw residential capital values decline 29.3% since the peak of mid-2014, a result of which saw residential sales transaction volumes leap since the previous year with a substantial share of purchases made towards apartments priced less than AED 1 million and villas priced between AED 1 million and 3 million.

Government-led economic stimulus packages and various residency visa reforms introduced during the last few months, in addition to the recent formation of a higher committee headed by Sheikh Maktoum Bin Rashid Al Maktoum to safeguard Dubai’s real estate market for the next decade - primarily by balancing supply and demand - are very welcome developments for the whole real estate industry.

A more centralised, well-planned strategic approach for government-based developers to address competition with their private sector counterparts, could help mitigate the demand-supply imbalance seen during the last few years.

Whilst this may not signal a pending recovery, it could positively boost purchasers’ sentiment as they decide that now may be a good time to invest. With Dubai’s safe-haven, tolerant, income-tax-free status, demand led growth will likely create a more balanced market going forward.

Given the unique demand-supply dynamics for Dubai, forecasts may change on a periodic basis, however based on currently available data, double digit declines in capital values are expected for 2019 followed by single digit declines or stabilisation during following years.

Market recovery will no doubt re-appear in the future as it has similarly done in the past, however, price growth is expected to be gradual and lead to a more sustainable recovery when compared to previous cycles.

Haider Tuaima is head of Real Estate Research at ValuStrat